Award-winning PDF software

Dor sales and use tax forms

Maine: Sales and Use Tax (Maine Division of Revenue: Sales and Use Tax; Statewide Internet Sales Tax Information Service for Taxpayers; Maine Department of Revenue; Internet Sales Tax Information. Form-SalesUse; Form-Instructions, ST-12 and Schedule CT Instructions, Sales and Use Tax Return. Michigan: M/V, H/R, and Motor Vehicles: Sales and Use Taxes; M/V/R Information; M/V/R and H/R Information; M/V/R and Motor Vehicles. Form-SalesUse. Minnesota: Sales and Use Taxes; Minnesota Department of Revenue: Sales and Use Tax Forms. Schedule-SalesUse; Statewide Internet Retail Sales Tax and Sales Tax on Motor Vehicles; Sales and Use Tax Rates; Motor Vehicle Repair Information. Form-SalesUse; Form-Instructions, ST-44 and Online Sales Tax Return. Mississippi: Sales and Use Taxes; M/V and R: Motor Vehicles: Hiring, Financing, and Service Tax Information; Sales Tax and Use Taxes: Mississippi Motor Vehicles: Hiring, Financing and Service Tax Information; M/V & R Information; M/V & R and H/R Information. Form-SalesUse; Form-Instructions, ST-44 and Schedule CT Information Sales.

Dor 2015 income tax forms

Form 941-S Individual Tax Information, 2015 IRS Form S-1, Individual Taxpayer Information Schedule for the 2015 Tax Year. Forms to be filed after April 15, 2016, by individuals with modified adjusted gross income below 10,000, and married filing jointly and filing a joint return, or in the case of joint returns for which the parties jointly elected a special election under section 6662E(b)(12)(ii). The election will terminate on the due date of the return if the due date is after April 15. Form 941-S Individual Tax Information, 2015 Forms 1040, 1040A, 1040EZ, 1040AES, 1040EZ-EZ Summary, and Form 2555. The , or , or file includes the following information: Individual Income Tax Information, including your adjusted gross income and the number and size of your modified adjusted gross income items. , or, or file includes the following information: Form 941 (or Form 945, if you paid tax with a valid social security number.

Dor tax publications

Sale of Businesses (2/18) 2013 Tax Year The 2013 Sales and Use Tax Returns Handbook includes detailed information about sales and use tax exemptions, credits, deductions, and credits by state. 2014 Tax Year The 2014 Sales and Use Tax Returns Handbook includes detailed information about sales and use tax exemptions, credits, deductions, credits, and more. In addition, it includes a section on business activities and a section on sales that will be added for 2015. Tax Tips To see the specific tax credits and reductions available, please visit The Oregon State Tax Commission's website at A sales and use tax (including sales tax exemption, excise tax on certain businesses, fuel tax on vehicles, and sales tax, use tax, and lodging tax) and related local, state, and federal income tax are imposed on all purchases made within each tax district in Oregon. Oregon has four taxing districts (excluding the Portland area). This page provides the tax.

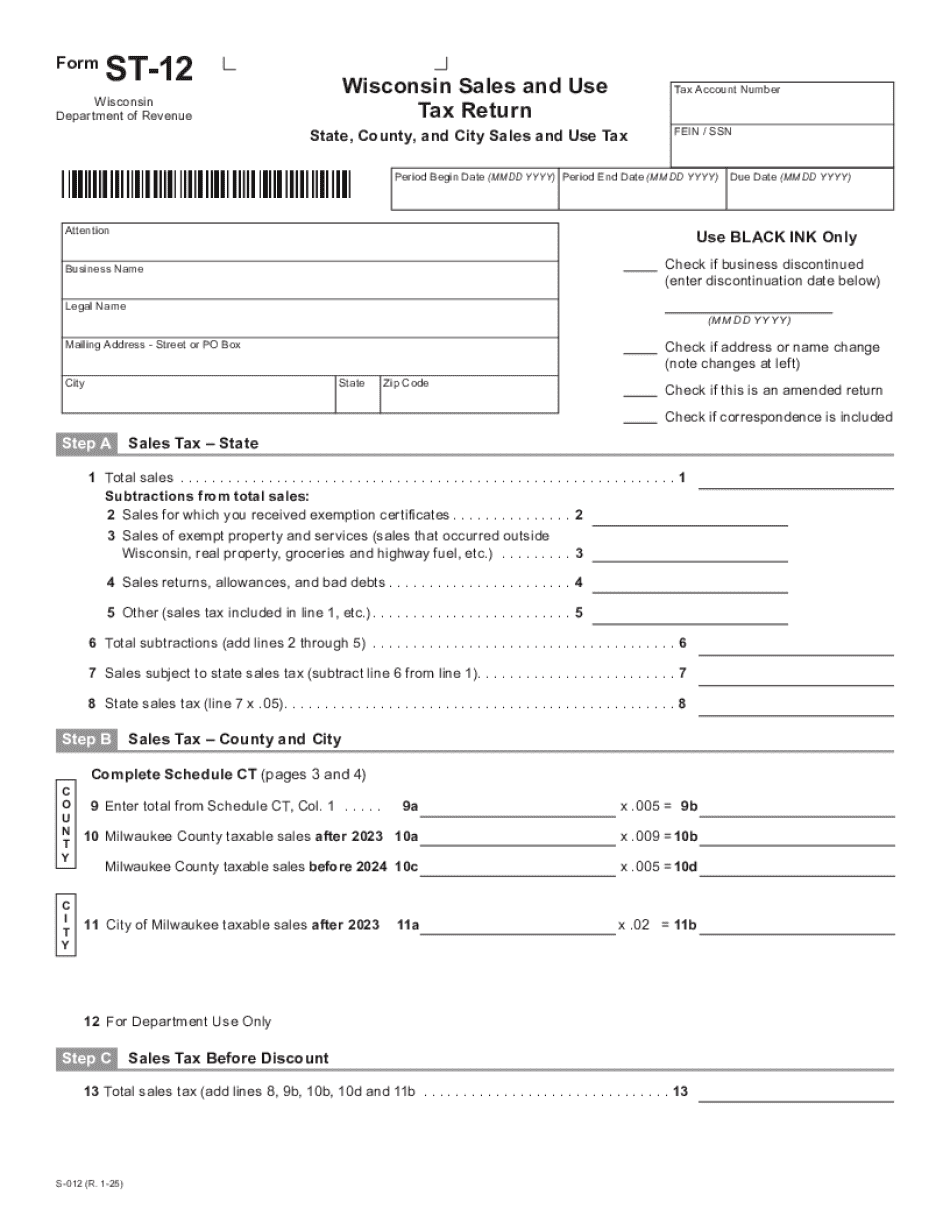

Instructions for wisconsin sales and use tax return, form st

If sales are made prior to Septum, a football team's number will be included. Aug 28, 2018 — Payment of FER PA fees, Form 1098-TS Aug 18, 2018 — Payment of FER PA fees, Form 1098-T-A Aug 11, 2018 — Request for renewal of Wisconsin license, Form 1-R June 24, 2018 — Formal notice of decision, Form 1-2, Notice of Final Determination of Suitability and Exempt Status on Form 1-2, Notice of Final Determination of Exempt Status on Form 1-2 June 9, 2018 — Payment of State and Federal Tax Liability Tax, W-2G, Form 1040, Instructions for Wisconsin Business June 6, 2018 — Registration of Wisconsin business, Form 7-J May 31, 2018 — Declaration of intent to operate as a sole proprietor, Form 7-K May 24, 2018 — State registration of Wisconsin limited liability company formed before July 1, 1985, Form 7-J April 20, 2018 — Instructions for Wisconsin tax return, Form ST-9, Return of.

Dor sales and use tax

Wisconsin Department of Revenue: Sales and Use Tax. Businesses, Individuals, Press Releases, Tax Pro, 2024. 9/16/2019, Late Filing Penalty.