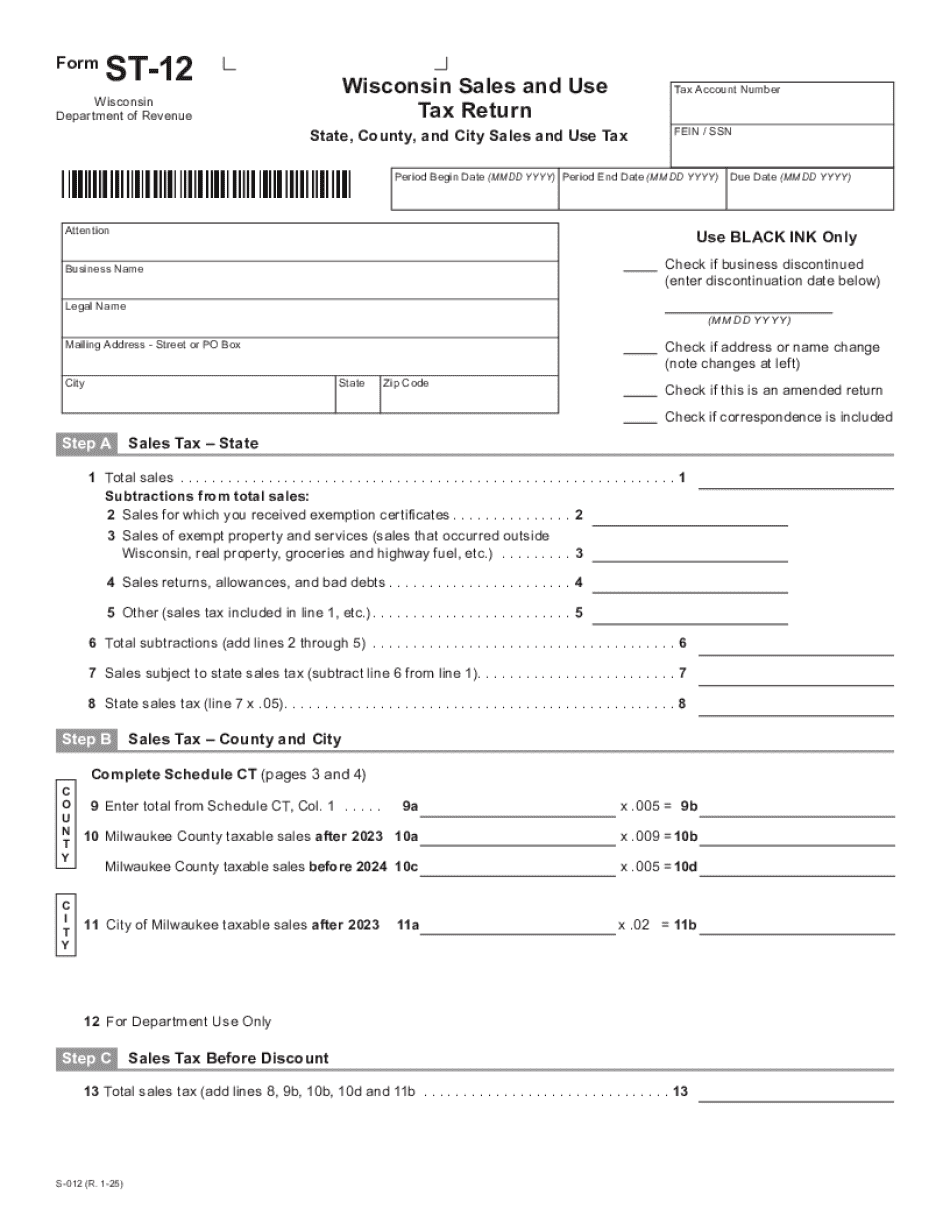

Now let's look at filing a sales and use tax return, paying the tax due, and amending a return. Your account list is customized based on your account access. To file a return, choose the sales and use tax account and click 'File Return.' If you don't see the period you want to file, click 'More...' and select the correct period. If you don't have sales or purchases for the period, check the box for reporting zero on every line and click 'Submit'. To report sales and purchases, follow this three-step process. All three steps are required, even if you're not reporting sales in steps 2 and 3. In step 1, enter your total sales, any subtractions, and total purchases. The gray fields automatically calculate. Report county sales in step 2. If you don't have sales or purchases to report to a county with a tax, check the No County Tax box and click 'ok'. The counties you reported tax to on previous returns are already listed. To add a county, click in the open field under the County column and choose it from the drop-down. If you need to delete a county, click the red X to the left of the county row. It is not necessary to delete the counties which have no county tax to report for the period. Enter your total sales subject to county sales tax and total purchases subject to county use tax for each county. Your total sales and purchases calculate automatically as you enter amounts. Report stadium district sales and use tax on Step 3. The total sales and purchases you entered in Step 2 are automatically entered in Step 3 for counties with both a county tax and a stadium district tax. If you don't have sales or purchases to report to a stadium district, check the No Stadium Tax box and click 'ok'. After you submit and agree the information you reported...

PDF editing your way

Complete or edit your st 12 forms anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export wi st 12 form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your st 12 form as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your wisconsin form st 12 by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare WI DoR ST-12 2025 Form

About WI DoR ST-12 2025 Form

The WI DoR ST-12 2025 Form is a tax document used by businesses in the state of Wisconsin to report their sales and use tax. It is used to report the amount of sales tax collected from customers and the amount of use tax owed on purchases. Businesses in Wisconsin that are registered to collect sales tax are required to file this form on a periodic basis, typically monthly or quarterly, depending on their total taxable sales. It is important for businesses to accurately report their sales and use tax liabilities to comply with state tax laws. Failure to do so may result in penalties or fines.

Online alternatives help you to manage the document supervision and also improve the efficiency of one's work-flow. Keep to the quick guidebook in order to complete WI For ST-12 2025 St 12 Form, steer clear of blunders and supply the idea on time:

How to perform a WI For ST-12 2025 St 12 Form online:

- On the website with the form, simply click Begin right now and also pass on the writer.

- Use the particular hints to be able to fill in established track record job areas.

- Add your individual information and contact files.

- Make sure that you enter appropriate data and amounts within correct fields.

- Wisely check the content material from the document and also grammar and also punctuation.

- Go to Guidance part if you have inquiries or even tackle the Assistance crew.

- Place an electronic unique on the WI For ST-12 2025 St 12 Form with the aid of Sign Instrument.

- As soon as the proper execution is completed, click Accomplished.

- Send out the particular set document by way of electronic mail as well as send, produce it as well as reduce your unit.

PDF rewriter allows you to create changes on your WI For ST-12 2025 St 12 Form from the net connected gadget, customize it according to your needs, indicator that digitally and also deliver in different ways.

What people say about us

Electronically delivering forms in the new field of remote work

Video instructions and help with filling out and completing WI DoR ST-12 2025 Form